BE A BALLER -"Building a lifelong legacy"

Welcome to Be A Baller, where we're building a lifelong legacy for our families, communities, and the world! I'm your host, Coach Tim Brown, and I'm excited to for you join me on this journey.

On this show, we'll be talking about how to be intentional about building a lasting legacy. We'll be exploring what it means to leave a mark that goes beyond just our own lives, but has a positive impact on those around us and even generations to come.

Our guests will be individuals who have built a legacy in various fields – ministry, business, sports, education, and community service. And what's unique about our guests is that they're committed to the Wisdom Pledge. That means they're not just sharing their own stories and experiences with us, but they're also paying forward and sharing wisdom to empower the next generation.

So if you're looking for inspiration, guidance, and practical tips on how to build a lasting legacy that makes a difference, then you're in the right place!

So grab your earbuds, get comfortable, and let's dive in!

BE A BALLER -"Building a lifelong legacy"

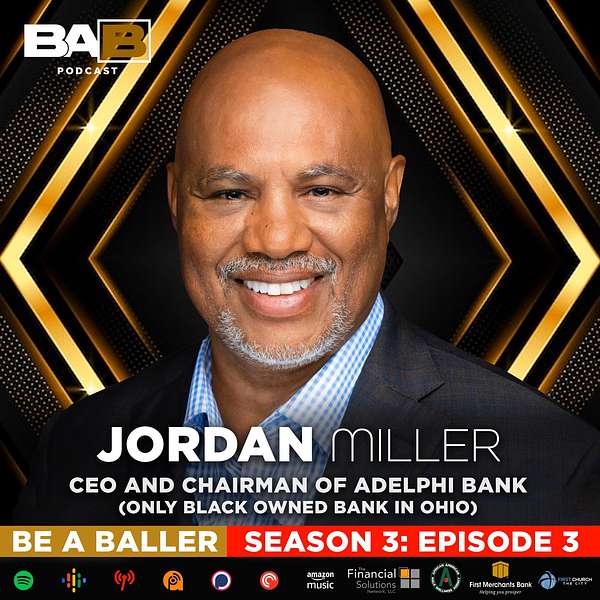

Jordan Miller, Chairman and CEO Adelphi Bank - Only Black Owned Bank in Ohio

Send us a comment about the Be a Baller Podcast Episode. Thanks for support.

As we celebrate Black History Month in this BAB Podcast episode we celebrate Jordan Miller, Chairman and CEO Adelphi Bank Ohio's only Black owned Bank. Jordan Miller who was CEO of Fifth Third Bank recounts the pivotal moments that carved his path to leadership. From his enlightening years in the Air Force to the mentorship that taught him the power of significance and advocacy, Jordan's story is an encouragement to inspire the next generation.

Our conversation takes a deep dive into the heart of community and faith, cornerstones that Jordan credits for his steadfast approach to life and business. He brings to life the lessons learned under the tutelage of Ralph Frazier, the 'Dean of African American Bankers', and shares how these principles sparked the creation of Adelphi Bank, Columbus's inaugural black-owned bank. Here, Jordan's commitment to legacy unfolds, revealing his vision for a financial institution that serves as a beacon of empowerment and financial literacy in a historically black community.

Wrapping up, Jordan doesn't just leave us with anecdotes and accomplishments; he imparts wisdom on how to build a legacy that echoes beyond the walls of business. With 35 years in banking under his belt, he urges the importance of setting a positive example and the necessity of personal financial management. Tune in for an exploration of the 'dash'—the legacy we craft with our lives—and let Jordan's insights inspire you to leave a mark that's both personally fulfilling and community-enriching. Join us on this journey of learning, empowerment, and reflection.

Well, everybody needs a mentor, but I'll tell you, more than a mentor, they need a sponsor. So they need somebody that, when that person you're helping is not in the room, they need somebody that's in the room, that can talk about their skills and their abilities and their commitment to the company and how they use their life to make things better. And so that's typically what I always aspire to be that sponsor. For those individuals that came behind me to help them not only just with the skills that they have, but to bring the best out of them, but ultimately to be in that room when they were being talked about, I said hey, I'm, guys ready for this next job.

Speaker 2:Welcome to Be a Baller where we discuss how to build a lifelong legacy. I'm your host, coach Tim Brown. Today we'll be talking about building a lifelong legacy with a Dow 5 Bank CEO, jordan Miller. Today on the show, jordan will share about his over 35 years in banking experience and his current role of being CEO of the first black owned banking, columbus Jordan. Welcome to Be a Baller podcast. Thank you, coach.

Speaker 1:Appreciate being here.

Speaker 2:Thanks for having me, yes this is going to be a blessing. Before we get into all the stuff you're doing now, let's talk about your childhood. You grew up in Columbus, went to Central High School and all that kind of good stuff. How was it growing up in Columbus so high?

Speaker 1:Columbus is a great place to grow up. We grew up in Milo Grogan, so you mentioned Jimmy Clemens earlier. He was our hero in our neighborhood. He was the baller. We were just wannabes but, spent a lot of time at the Boys and Girls Club. It was just a boys club back in those days. Cleveland Avenue went to Milo Grogan School, later went to Monroe Junior High School and ended up at Central Central.

Speaker 2:I was doing a little research and I found that your dad was a World War II veteran. That's right. Let's talk about the life lessons you learned from him.

Speaker 1:Man. I would take up a whole show there. My dad was a humble man, very humble. He was a disabled veteran of World War II, his leg shot off at the end of that war. Went back to his home state of West Virginia he went to college being moved at one leg. You can't work in a coal mine, which is what everybody in West Virginia does.

Speaker 1:He moved to Columbus, worked out at the depot we called it, but DCSC. Later taught high school, taught mechanical arts and drawing and woodshop and all those kind of things. That's the kind of stuff he was really involved in. He was truly his background and profession. As a carpenter he did all kinds of projects Growing up with him. Every Saturday morning early in the morning we would go out and fixin' somebody's wiring or their porch or their roof or installing windows or doing something like that, so cutting grass. Even I was just a guy that was all along for the ride doing all the do this, do that, go here, go there, honey, do this. But yeah, he was a great man. I learned so much from him, especially about being humble and respectful to other people and just being a good neighbor.

Speaker 2:Yeah, sounded like you quite the handyman.

Speaker 1:Like that you doing all the stuff around the house. I tried it all and I learned that doesn't my thing.

Speaker 2:Did you pass some of those skills on to your sons?

Speaker 1:Not a whole lot, but not those kind of skills I think the humbleness, respect and all those good life lessons that we learned from him and the churches and all that stuff. That's the stuff we kind of more influential in the past, those kind of traits along.

Speaker 2:You know you're being a finance guy. Does you always have interest in money?

Speaker 1:Well, my mom was a saver. She could turn two pennies into a nickel. But she always taught us how to save and we got a small weekly allowance and it had to last a whole week. So don't come back here on Thursday telling me you can't make it to Friday. You need another nickel for your lunch money. I gave you 50 cents at the beginning of the week. I learned a lot from her about budgeting and planning and taking care of the books and making sure I paid my bills on time and that kind of thing. There's more to this, about saving for her.

Speaker 2:Remember the good old penny candy days, piny candy yes, that's right.

Speaker 4:Hey there Clark Kellogg here. Building a legacy usually involves meeting the unique needs of others and being part of something bigger than yourself. That's why I love First Merchants Bank. First Merchants believes that helping communities prosper means more than just providing banking services. It means offering accessible financial education, expanded access to home ownership and partnerships with local nonprofits to help raise up neighborhoods and live families out of financial hardship. For resources and tools available to you, visit wwwfirstmerchantscom. Member F-P-I-C Equal Housing Lenders.

Speaker 2:You know, at the high school you had a brief time at Ohio State and then you were in the Air Force for six years. Can you talk about how that helped you become the man and leader you are today?

Speaker 1:Yeah Well, my experience at Ohio State first shaped me, but I had an internship that they sent me on from Ohio State I was a business major or accounting major at the time and I get over to the accounting firm and they like my hairdo. I had a big afro baggy of days, but that was maybe before the time. I didn't realize that, but so I was a little frustrated with that that I had the world's shortest internship.

Speaker 1:I call it in the Air Force and I forgave myself when I was in the Air Force because that's when I really learned. I got the chance to go overseas and travel, meet different people all walks of life and really discover who I was. And I was a good person and I was serious and I was a good accountant and I was a good math guy. So, the fact that that didn't work out for me, I finally forgave myself for letting that go and I decided that I needed to continue my college, which I did.

Speaker 2:You know you've been in banking for all 35 years now. When did you know that that was your career?

Speaker 1:Well, after the military, I had completed my college by then and I decided that I had a friend of mine that was in banking and he mentioned to me about being a bank examiner what it was, and it was similar to me Before that I wanted to be an accountant so I thought, okay, I'd change majors to finance and working with Comfort of the Currency as a bank examiner was very similar to an accountant. You go bank to bank to bank. You kind of learn what they do, evaluate their efforts in different areas, about management and capital and their assets, which are pretty much their loans and investments. And it was just really exciting to learn banking at that high of a level at that early of a stage in my life and just got into it. I love the mission, I love what banks do, helping their communities, and so that distance for me.

Speaker 2:You guys are bankers. You've been described as a trailblazer, a role model and a financial freedom fighter. That's the word on Mr Miller. Okay, I don't know who did that.

Speaker 4:What does that?

Speaker 2:description mean to you being at Trailblaze and Roll Mine and Field.

Speaker 1:You know, I never thought of myself as a Trailblaze. There's always somebody that comes before you and hopefully there's always somebody coming behind you that aspires to be through the things that you did. So what I wanted to do in banking after initially getting into banking, being a bank examiner and learning a lot of the back office functions, the county functions, all that kind of stuff I realized I want to be a real banker. I want to go out and develop business. I want to help business owners. I want to help families that want to sit their kids to college. I want to help families, you know, realize their goals of retirement and financial planning and all those kind of things. And businesses hire more people and get more contracts. And so that's when I realized, that's when it touched me, when I knew that I was helping people black and brown people, mainstream people didn't really matter. I was helping businesses and I was learning so much as I'm helping people. And that's what caught me about banking. That's why I love it, that's why that's why I'm doing what I do today.

Speaker 2:You know, once you got involved in the bank as a young banker, who was someone who was personally meant to achieve yeah Well, the primary guy that I met was a general counselor at Huntington Bank.

Speaker 1:His name was Ralph Frazier and Ralph we call Ralph the Dean of African American Bankers in the state of Ohio because he probably was the highest ranking African American in banking at that level and there weren't a ton of us in those days. There wasn't a lot of blacks in banking. It's a pretty conservative industry.

Speaker 1:But I learned a lot just listening to Ralph and being in meetings and I would go to his office and he had a big telescope at his office on the 34th floor up at the Huntington Center downtown and we would look out that. We'd talk about the issues in the community, talk about the school systems, talk about the people. We'd talk about the churches, we'd talk about who was getting it right, who was getting it wrong, and just learned a lot from lessons from him about how to carry yourself, how to conduct yourself, how to be significant and whatever it is that you were doing. I think that word significance was always pushed, that I mean, okay, go do something, do the best you can, but whatever it is you're doing, be significant, and so that took that lesson from him.

Speaker 2:You know, going back to your colleagues, I've been talking to your colleagues. He talked about you being a champion for the next generation in banking. Why is it so important for you, the way Ralph mentored you, to mentor the up-and-coming people of color, just in the banking business?

Speaker 1:Well, everybody needs a mentor, but I'll say, more than a mentor, they need a sponsor. So they need somebody that, when that person you're helping is not in the room, they need somebody that's in the room, that can talk about their skills and their abilities and their commitment to the company and how they use their life to make things better. And so that's typically what I always aspire to be that sponsor for those individuals that came behind me to help them Not only just with the skills that they have, but to bring the best out of them, but ultimately to be in that room when they were being talked about to say, yeah, that guy's ready for this next job, wow that's powerful.

Speaker 2:I never heard of said that. We always talk about mentors. I love that sponsor analogy Once that person's out the room, you got to have somebody at the table fighting for you or vouching for you and, trust me, it's always a fight.

Speaker 1:It's always a fight because everybody doesn't see the person that you know and they don't necessarily always see that commitment. They're more likely to see a mistake that that person's made or something that they didn't like about them versus all the good that they've done. And my job is always to beat up. Well, yeah, everybody's got challenges and everybody's got issues, but let's talk about the good things this person does. Let's talk about their faith, their belief, their goals that they have and their discipline and what they do with their families and how they move forward a community versus they made a mistake and they got a C plus in math instead of May.

Speaker 5:The team at the Financial Solutions Network is proud to partner with Tim Brown and bring you this episode of Be a Baller. Our mission is to share generously of our time, talent and financial resources to help our clients develop financial plans and wealth management strategies that allow them to live the lives they imagine, while connecting them with experiences and people that enhance their quality of life. Fca is one of those organizations, by helping young men and women through the development of their personal faith. The Financial Solutions Network is an independently owned and managed wealth advisory firm based in Worthington, ohio. We are a multi-generational professional team of advisors with a combined 83 years of experience teaching and managing financial strategies for individuals, families, businesses and institutions. We will be honored to help you plan your financial journey. Contact us at 614-505-3025 or visit our website at tfsnnet.

Speaker 2:I know you mentioned a couple times about your faith. Can you talk about why your faith is so important to you and how that has helped you during difficult situations? I'm sure there's some challenging times, yeah definitely challenging times.

Speaker 1:Well, I was involved in church from ever since the time I could remember my mom. As soon as we could walk, we walked across the bridge, we went to Trinity Baptist Church and my pastor, Param boy. He was a disciplinarian but he was tough, he was smart, he was bright. We went to the vacation Bible school every summer and I just spent my whole life just growing up in church and learning the values of church, not just the word in the book, but taking those lessons that we learned from those biblical folks and applying it to ourselves. It just always stuck with me.

Speaker 2:Yeah, that's the key making it become real. It's not just words on a page where Jesus said this. God said that this becomes real in your life and you begin to work it out, yeah, and I tell you what?

Speaker 1:I tell you what, as children, we don't always. It's not what we read, it's what we see people doing. So when we're in church and we see good church people and then we see a mountain church and they're not acting like good church, people do that kind of consour here, son, because because we are as people of example, we have to watch what we do because somebody's watching, and that's what I always. I always had my eye on the next guy above me, whoever that was, and see how they carried themselves. And those faith-based folks, we're consistent in their application of what they, what they did every day, how they treated people.

Speaker 2:That's good, as you say, that always share young people working with young boys a lot Say a lot of guys. They don't have a man, somebody sit down and talk to them, but they watch yeah, they watch me, catch it, what they see. You know more from what they see. And what really sitting down talking to Is it watching. That's right. Watching.

Speaker 1:How important they are more watching than my actually reading something.

Speaker 2:It's good you know this, your ball of podcast. It's about building a lifelong legacy. What does that word legacy mean to you?

Speaker 1:Yeah. So I think a legacy, I think of that. You know that dash. You know that dash when you tombstone, that's part of that dash that you made what I say, a significant difference. What did you do? What did you leave the place better than you found it? And that's that, to me, is the definition of legacy, and that dash is full of your accomplishments and your legacy, where they're good or bad, everybody leaves one, and so, but my goal and that legacy was always to Leave a good example. You know, be positive. You know help, be helpful, bring something to a, to a situation that improves the situation, that makes it worse.

Speaker 2:Hmm, it's good, it's good. You know we can't leave this without talking about your legacy project, that's the Adalfa Bank, as the first black owned bank in Columbus in Ohio. You're retired, you know, getting ready to work on your golf game, and the word is you get a call from a good friend, frank, and County Commissioner Kevin Boyce. Talk about that call and the reason for you deciding to be involved in this project.

Speaker 1:Yeah yeah, kevin is a good friend. Kevin and I, we work together. When Kevin was a state treasurer and before that City Council, I was a banker and we did a lot of services for the state. And Kevin called one day after He'd been involved in a situation Marks downtown, the black lives matter and George Floyd had was the subject of that walk in that protest and they got a look too close and he and a couple of his folks Joyce Beatty and and our city council President Shannon Harding they got maced and and from that this idea was for. So Kevin called me one day and says hey, I'm thinking about starting a bank. Would you consider At least reviewing the deck and viewing the progress and being some guidance? And so I did some research and I saw where black folks were on the financial totem pole and once I looked at those numbers it was like, yeah, I mean, what can I do to help?

Speaker 2:And what did you do to help we?

Speaker 1:Started. That took about two years. We raised the money, we put together the business plan. We you know he's consultants to help us, he's legal folks to help us. I knew a lot of the regular regulators are ready because I've been involved in banking and I've been on the state banking commission for a long time before I retired from pit third and Called them up. What we got to do, kind of there is no actual blueprint Okay, but there are. There are processes and there's a lot of communication. There's a lot of things you have to do. You have to find people, you have to find executive team. I had, we had to get a board and we had to decide where we want to be. We had to get space filled out. So there were a lot, of, a lot of things during their project. And so just keep your head down and and just do work and like, find your way through it and then finding one day they get the letter from the regulator say you've been approved. So the dog caught the car. Now what's gonna do that?

Speaker 2:You talk about significance. What was the significance of the bank being on Longstreet in Lincoln Browns? What's the significance of that location?

Speaker 1:well, taytooth coach. We did not necessarily planned to be in any single location. We knew that we wanted to be in a historically black community. So we're looking at Old Town East area, we're looking at King Lincoln area, we're looking at Linden area and we found this project. And I got a call from somebody say, hey, there's some spaces going to be available at this new apartment complex. It's in the ground floor space and you might want to check it out. So when we got there I discovered the history that there was a black owned bank from 1921. That bank was formed Later. I got the names of the individuals and found that they were my fraternity brothers. Anyway, we, we decided to adopt the name Adelphi. They were called Adelphi Building Savings and Long Company, and Adelphi is a Greek word for brothers. And so we, we just adopted that name and decided that was the place we wanted to be.

Speaker 2:We got the space built out and now we call home you know as we come around the corner, we cannot, I cannot let you leave without giving young people and adults a word on how to protect their finances and how important that is from your 35 years of experience.

Speaker 1:Yeah, this is one of the most important things you can do on your finances are. That is your story. That is who you are. You can't do anything today without credit. You can't do anything today if you don't. If you don't, you don't carry a card in your wallet. I mean you can't carry cash. I mean no, half the places don't take. But the number one thing is to me, it's it's. You have to stay within your means, whatever that is, whatever, no matter how big the number is that you take home. If you spend more than that, you're gonna be broke. And I see a lot of kids that get out of school and get great jobs. I wish I could get paid out of out of college when some of these kids get paid.

Speaker 1:When we graduate from college. All we want to do is make our age which is $20,000 a year. We're 21 years old.

Speaker 3:We want to make $20,000.

Speaker 1:That's a great number.

Speaker 1:That number right now. It just be. You just be broke and you cannot support a family on 20 grand a year, for sure. But the number one thing is you cannot spend more than you make and you have to understand what you make. And the second thing is what do I spend my money on? And I'm obviously family, helping, friends, saving, and saving is such a big component in the amount of time that you have to save the better off. So if you're 21 and you start putting away, rather than going to Starbucks at least once a day to stick that five bucks and putting away five bucks a day, I mean by the time you're 40, 45, you've got a little nest egg. But because it's the amount of time that you have versus the timing of the market, everybody's trying to predict when the market going to go up is the market going to go down.

Speaker 1:Well, nobody knows, if we all knew that, we'd all be rich. But it's the amount of time you have to consistently invest in dollar cost averages in the market. It's the most important thing you can do, well.

Speaker 2:I appreciate you breaking us down in layman terms.

Speaker 3:I can understand that at the time.

Speaker 2:You know, joe, as we wrap up, I want to thank you for answering that call and listening to what they call them. Kevin Boyce, you know, and look at what God is doing and continuing to do and the benefit it is to our people. Thank you Just having that presence there, you know, we can walk in and the pride, the pride I think about your dad and your mom, ancestors. You know people who lived in that area. Yeah, how proud they are now. You know what's going on there because of you answering that call.

Speaker 1:Well, I appreciate being called and I'm glad I picked up the phone. I'm glad I decided to do it.

Speaker 2:It's probably more work than what I want to do at the time frame them in, but it's better than missing a bunch of putts in the golf, or maybe not, that brings us to this episode, thanks to our special guest, jordan Miller, for sharing his many years of service helping people become financially independent and his vision for the success of the Black owned bank in Columbus. As always, thank you for joining us, doing this enlightening forum discussion and building a legacy in business. Hope this episode was beneficial to you. As always, be a baller, appreciate you, thank you.

Speaker 3:If you enjoyed this episode, please share this podcast with family and friends. Be a baller podcast is available on all major podcast stations. Be sure to come back next week as we continue to discuss on how to build a lifelong legacy. Until then, don't forget to be a baller. This podcast was created by coach Tim Brown. It was edited by Tehran Howe and produced and recorded by the video production class of Worthington Christian High School.